Lucas Sebastian Wiese

MSc. Corporate Management & Economics

The Bitcoin Cryptocurrency 2020-2022: Network Analysis on High Activity Addresses

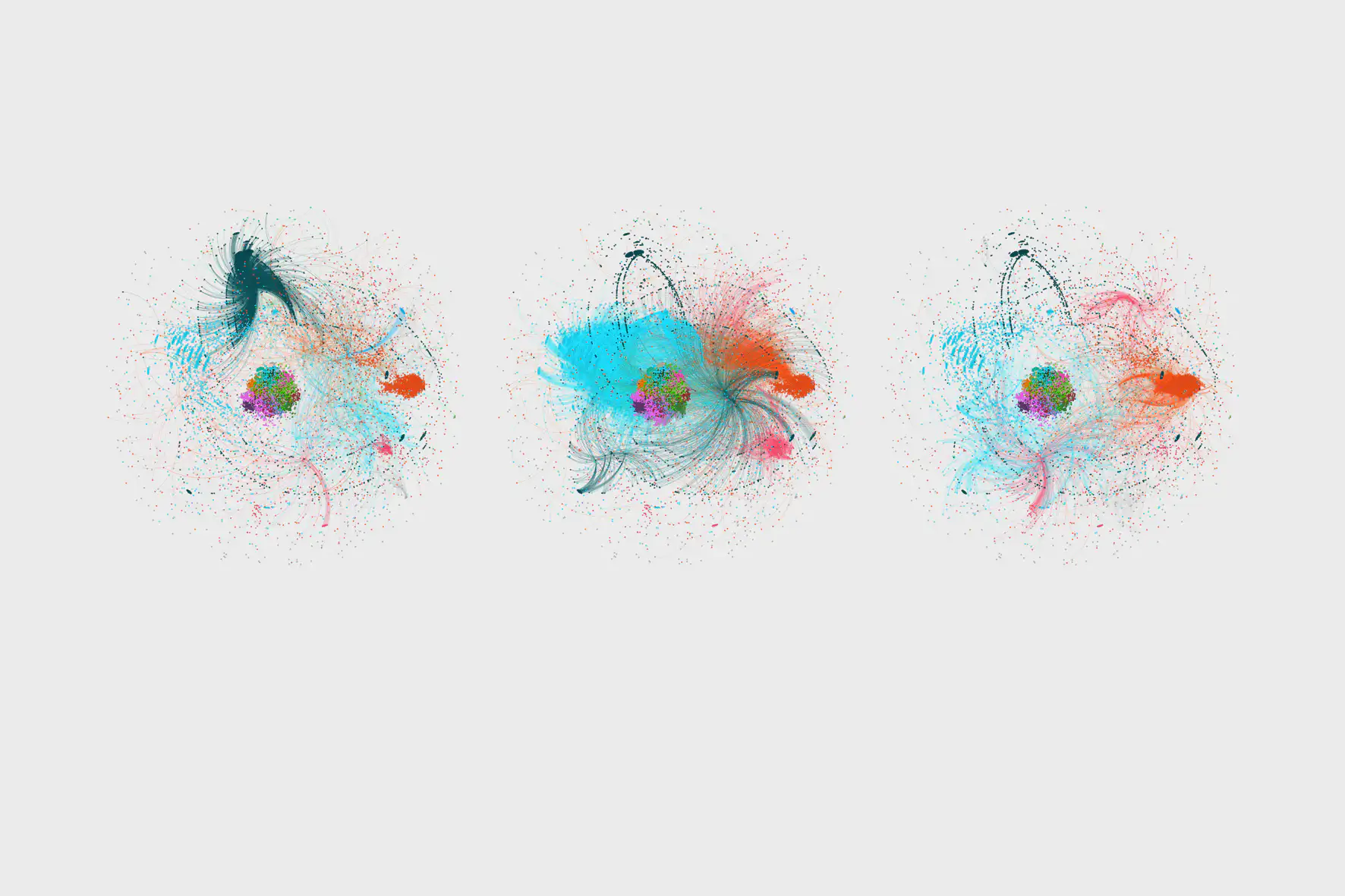

The attention that the bitcoin cryptocurrency has experienced in recent years has led to increased transactions and actors. Thanks to the decentralised structure, transparency and public availability, all data on the bitcoin blockchain for 2020 to 2022 could be extracted and analysed. Specifically looking at the movement of high-activity addresses with more than 500 weekly occurrences, individual weekly networks were created, clusters identified, and their interconnectivity measured and visually represented using Gephi. Extracted network parameters were observed and regressed to explain their influence on the cryptocurrencies price and volume. Through the analysis of structural breaks, bitcoin’s role in the Russia-Ukraine crisis was highlighted, illustrating the possible reasons for changes in network activity using data collected for high-activity transactors. Ultimately there are countless areas to explore to understand and make blockchain-based applications such as cryptocurrencies safe, for which this paper and its methodology provide a possible foundation.

Introduction

Over the last few years, cryptocurrencies have received increasing attention not only in their intended usage and popularity from actors but also from a data science and research perspective. Thanks to the decentralised structure, transparency and public availability, all data on the bitcoin blockchain can be extracted and analysed. Furthermore, the attention and high usage that bitcoin has experienced in recent years, provide the possibility of gathering large amounts of data.

Cryptocurrencies are generally starting to become increasingly accepted as a form of payment, but they also provide the structure and platform for consumers. Together with other applications running on cryptocurrency and blockchain networks, a large amount of data is created, containing detailed and publicly available information. This can provide the opportunity to leverage this information, learn from it and discover possible trends and applications. Even though bitcoin blockchain data proves to have a certain degree of anonymity, companies like Chainanalysis have made it their goal to professionally investigate, track and identify individuals for various purposes and connect transactions to real-world entities. With more and more users and use cases of cryptocurrencies, it is imperative to make it safer by upholding its transparency and increasing its users' accountability. Besides government entities and regulations, analysing the blockchain can benefit companies and provide helpful information and insight. There are many different possibilities and alternative ways to analyse and represent certain information on the bitcoin blockchain. Without going deep into decentralised applications and smart contracts, this paper will focus on analysing the activity of a small segment of this data's high-activity addresses and their weekly activity from 2020 through to 2022.